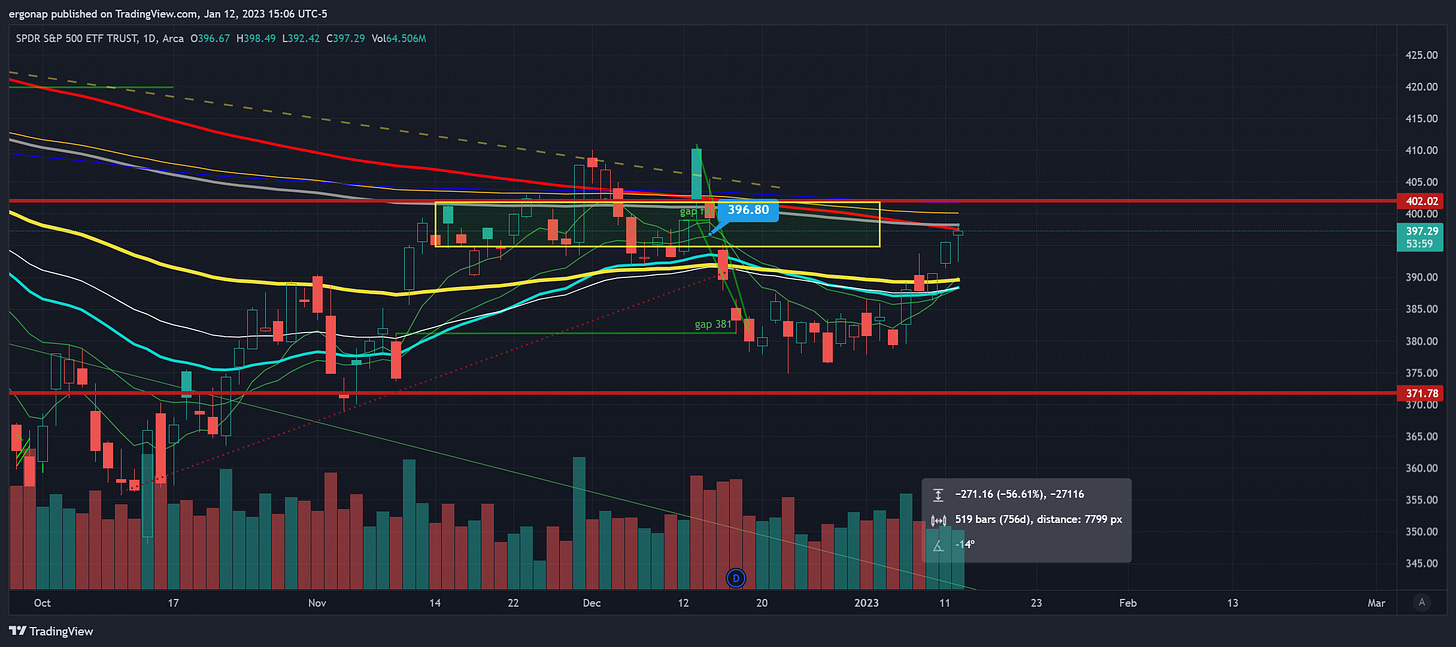

So today, SPY 0.00%↑ hit the top of the last gap they had waiting. Which had a lot of ties to other TA, fundamentals, etc. Now comes the bottom. Which is going to be an ugly, ugly, indeterminate bottom. It’s referred to by me as negative price discovery, and that’s what’s coming. So…….first technical data, then fundamentals.

On technicals, we gapped this 397 a month ago, exactly. It’s amazing how much people tended to forget, but whatever.

It’s magically the top of the daily 200MA/200EMA, all in one go. Yep, here it comes folks. Notice the volume isn’t exactly consistent with this being a serious move, either.

Long term swing indicators likewise do not agree either, 20/200 says whatever don’t bother.

Ichimoku and keltners basically say this is bearish/toppish as well. Hopefully, hopefully you can see where this is going. But again, this is just from technicals. So let’s get into the rest of the sorts of data that exist.

We’re magically sitting at exactly 4000 on the Micro ES right now, and Open Interest has not been rising with this move at all.

One last thing to mention: This is the spy. The DJI / NDX doesn’t look this ugly, but is prepping for the same sort of crash.

I think that’s enough technical data to show where things are either slightly at a pivot or relatively bearish. Not a lot of clarity in most technical things outside of “this is a bounce”. So what else do we have? It’s going to be important to keep in mind things like SPYG 0.00%↑ and TSLA 0.00%↑ and AAPL 0.00%↑ , COST 0.00%↑ and GOOG 0.00%↑ , also divergent stocks. Why? Let's go look at P/E as one highlight of a problem. Hmm!

Sure sounds like maybe we should be looking at MSFT 0.00%↑ , NEE 0.00%↑ , HON 0.00%↑ , ADP 0.00%↑ , SHW 0.00%↑ , GFS 0.00%↑ , LUV 0.00%↑ .

Considering the fight between China and the US over GFS that’s been ongoing (note article: 2019) and escalating lately, that’s a pretty dangerous precedent. If GFS has financial issues from either China being cut off or something else, not good timing at all. That certainly adds more risk to China having nowhere to go, and does spell risk to the tech sector.

Microsoft being top of the list and making noise about buying ChatGPT in the mix just confirms they’re overvalued and know it. I bet they’ll sell off plenty of shares shortly to go after that. $10b is indeed less than say 1% of their marketcap (0.5% IE 0.005), but considering they’d be able to destroy ChatGPT in seconds, ads up. Yet another “shocker” as it fades into irrelevance from Microsoft’s Halloween strategy (embrace/extend/extinguish). Another good point to cite is a bunch of data from Lykeon that sums up in words the general issue:

2023 is likely to be one of the hardest-to-forecast years in recent memory.

The US government will need more than $15 trillion of financing over the next ten years.

8 out of the 10 best performing S&P 500 stocks in 2022 were Oil & Gas related.

It’s hard to forecast because it’s a regime change, something fundamental folks can miss sometimes. Interestingly, they cite 2003. Although I still lean towards 73-74, it’s all more or less the same. Though this isn’t fundamentals as much as pattern recognition anyway.

Here’s a bit of the clue implications for MSFT 0.00%↑ : Finviz: MSFT.

What are we looking at? That they’re burning money per share and want to spend more on chatGPT. The catch? They have enough money to just do a mass tech layoff. Which is likely what we’re about to see, as they’re known to do these (q4 2022). It fits with the whole yay capitalism vibe.

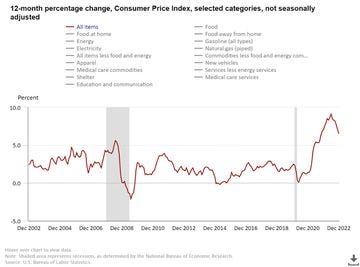

We could pump one more day, but the issue is the extended downturn I expect in the stock market, because we haven’t had any form of recession thus far. So now? Now is the time to slowly start buying. Real slow. Like 1% a week sort of thing, from here. Do you have money to spare to do that? probably not, considering all sorts of other factors. I mean the Market is rallying on 6% CPI for 2022. Then again, why not show you the last time we had a sharp drop after spiking? Anyone remember the date?

There are so, so many problems from here. However, fear not! Fed has firmly prepared a very sharp spear to put directly into the hearts of consumers, because they have said. Ah well, let’s just source the Powell quote from MSNBC, on what’s to come. This means: they realize politics are stupid, and they will fix the economy! Good! Meanwhile, anyone against it is going to scream about too much debt/debt ceiling, while Powell comes in swinging. Here’s to potential interest rates above 5%, or at least 5%, with this quote. Which means: markets need to move down.

Powell: restoring price stability when inflation is high can require measures that are not popular in the short term as we raise interest rates to slow the economy